In the fourth and final quarter of 2022, the BEV – Italy Progress Index qualitative analysis by Quintegia shows a modest sign of growth, with a score of 44.6, fostering hopes for a recovery in the electrification process in Italy,despite a significant drop compared to the same period in 2021 when a score was 12 points higher. A slight uptick influenced by registrations, which gained ground at the year’s end, compared to the third quarter of 2022, which had closed at 43.8.

Sustaining the situation are the numbers related to infrastructure: with a score of 72.3, always referring to the last quarter of 2022 during which 2,634 units were installed, they confirm constant growth and are increasingly aligned with the goal. Compared to 2021, infrastructure increased by 46%, with a total of 19,334 elements. On the highway network, 378 more charging points were generated in 2022.

In terms of charging power, 88% of the charging points installed throughout Italy are alternating current (AC), while 12% are direct current (DC). Installations with increasingly higher powers are growing: in addition to the doubled share of DC points (in 2021, DC points were around 6%, compared to 12% in 2022), the share of ultra-fast points (with power over 150 kW) has tripled – source “Report on Public Charging Infrastructure in Italy” published a few days ago by Motus-E.

Looking at 2022 as a whole, the BEV – Italy Progress Indexdescribes a difficult year for electric cars in Italy, with registrations down 26.6% compared to 2021 (with 49,500 BEVs registered in 2022). The last three months of the year marked a slight recovery, but still not enough. From July to September, just under 11,000 electric car registrations were counted, rising to over 13,000 in the final quarter.

The month of December, with 4,500 BEV registrations, was not as impactful as in previous years but in line with the other months of 2022.

From October to December, the private sectorrecorded a share of 47%, followed by short and long-term rentals with 29%, self-registrations with 14%, and companies with 10%. Among the European Union states, our country ranks 18th out of 26 in the BEV market share with 3.7%, against the 12.1% average of the European Union. The opposite direction for the situation of public charging infrastructure in which Italy is doing well and with a very high growth rate. In 2022, in fact, over 6,000 infrastructures were installed, almost half of all those already present on the territory at the end of December 2021.

“The decision confirmed by Europe that foresees the stop to the production of diesel and gasoline cars requires an extra effort to prepare our country for the change. The results of the index, if evaluated in the totality of 2022, illustrate a still limping rhythm. Certainly, it is undeniable that exogenous factors have had an effect on the speed of development of the electrification process. Quintegia’s analysis, along with the broad reflections and concrete solutions that will emerge from the next edition of Automotive Dealer Day in May, will be the point of reference to support the automotive sector so that it can correctly aim to reach the final goal, also with the indispensable support of the Government,” declares Nicola Pasqualin Senior Researcher & EV Expert, of Quintegia.

The BEV – Italy Progress Index* takes into account three main components:

- the BEV (Battery Electric Vehicle) circulating fleet,

- quarterly BEV (Battery Electric Vehicle) registrations,

- electric charging infrastructures, the latter evaluated both for diffusion and power delivery.

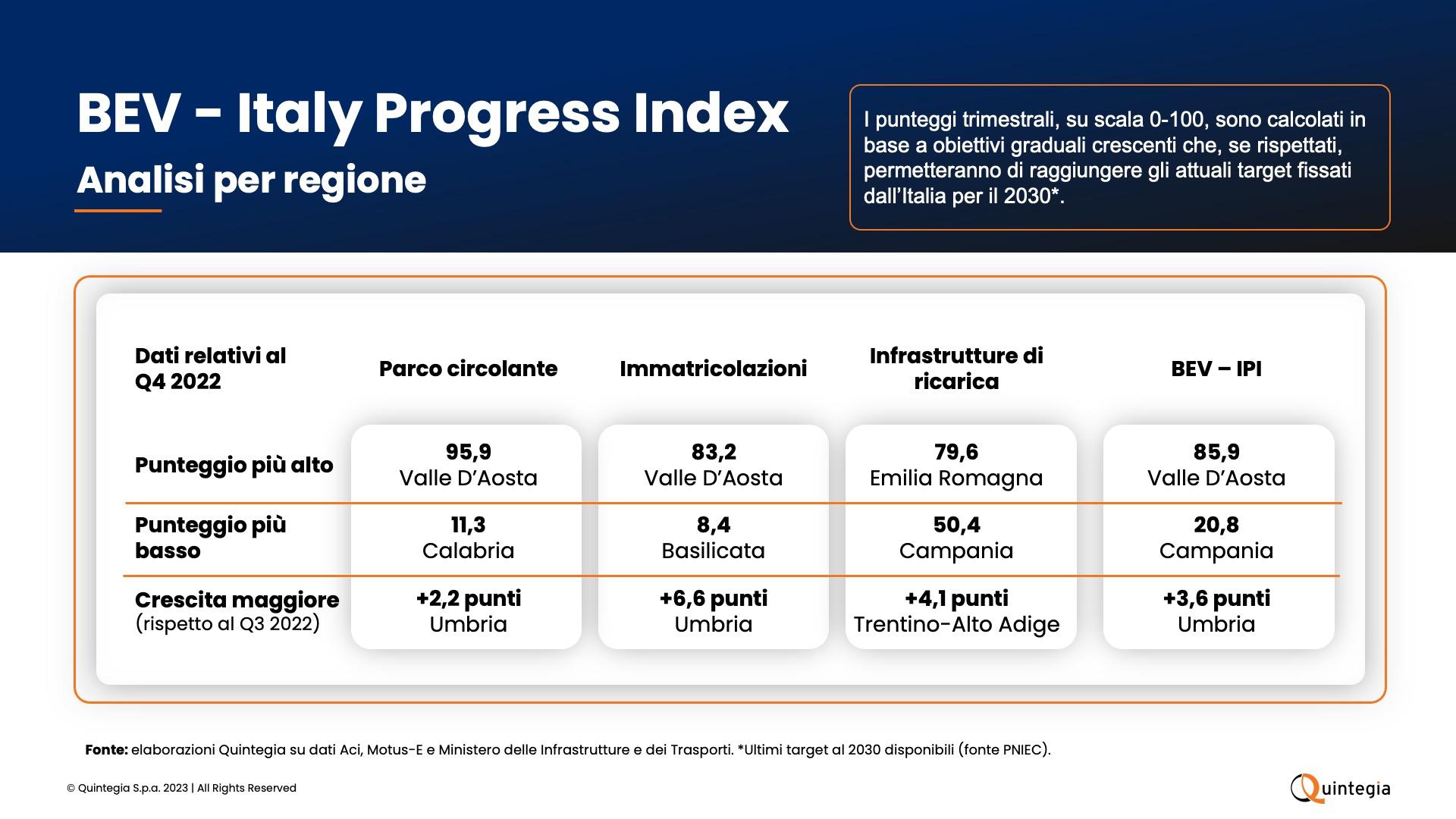

Regarding the circulating fleet, in our country, the number of vehicles in 2022 exceeded 167,000 BEV units, which in percentage terms means +41.5% compared to 2021. From a regional point of view, considering the data purged from the rental component that greatly influences the registered in some provinces, in terms of circulating fleet and registrations, the Valle D’Aosta is the leader.

If the infrastructural network is considered, Emilia Romagna is in first place with 79.6 points, while Campania remains at the bottom with 50.4 points. The average of the Italian regions is slightly growing with 68 points compared to 66.5 of Q3 2022.

The cost of a full energy refill.

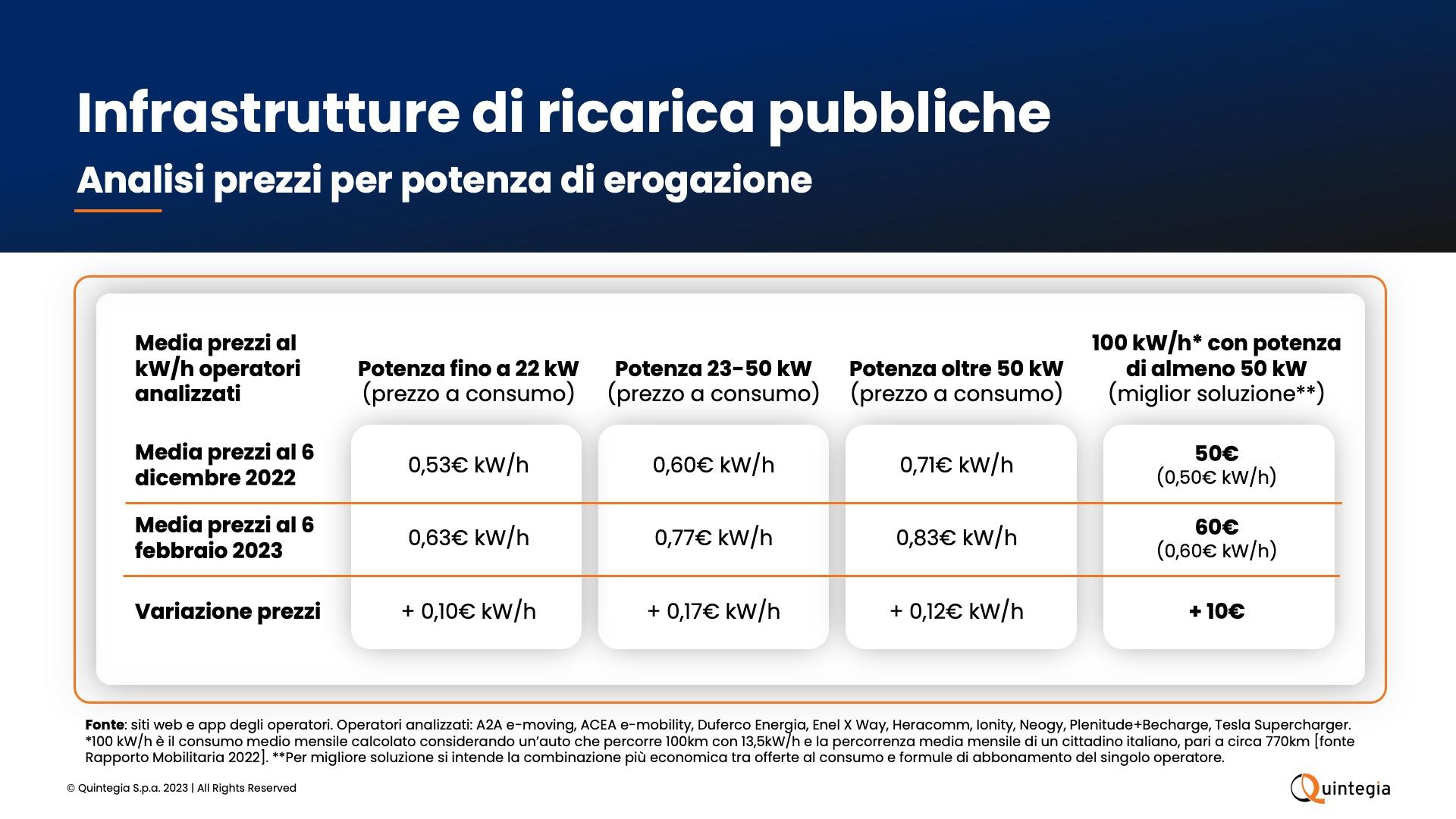

Considering the 9 operators present in the Italian territory with their own public infrastructure, the average of the consumption prices alone for a charge up to 22kW of power is €0.63 per kW/h, up to 50kW of power is €0.77 per kW/h, and above 50kW of power is €0.83 per kW/h. These figures are updated to the first week of February and have risen compared to the first week of December 2022, specifically by +€0.10 per kW/h for the range up to 22kW, +€0.17 per kW/h up to 50kW, and +€0.12 per kW/h above 50kW.

On average, an Italian citizen travels about 770 km per month [source: Rapporto Mobilitaria 2022] and assuming the use of an efficient electric car around 13.5kW/h per 100km, the monthly consumption will be about 100kW/h. Calculating for each operator the cheapest solution to recharge 100 kW/h at least 50kW of power per month, considering both consumption offers and subscription formulas, the average price results in €0.60 per kW/h compared to €0.50 per kW/h at the beginning of December. Therefore, recharging 100kW/h will cost on average €60. The cheapest operator allows reducing the cost to €45 for 100kW/h, or €0.45 per kW/h. In the case of higher monthly mileage, there are solutions that guarantee cost containment up to €0.35 per kW/h.

* The BEV IPI provides a range from 0 to 100, and indicates the percentage of achievement of gradual increasing quarterly targets that, if met, will allow Italy to reach the latest available targets set for 2030 (PNIEC – National Integrated Plan for Energy and Climate).

(Source: Quintegia elaborations on ACEA, Aci, Motus-E, and Ministry of Infrastructure and Transport data)