27 new automotive brands have arrived or will arrive in Italy by 2028, 90% of which are Chinese.

There are 27 new automotive brands that have arrived or will arrive on the Italian car market by 2028, 90% of which are Chinese in origin or ownership. And the market share of those already present is now close to 6% (5.8% in the first quarter compared to 3.7% in 2024), a surprising leap from 0.4% in 2021. This is the first point highlighted by the New Brand Observatory, presented this morning during Automotive Dealer Day – House of Mobility.

Quintegia’s study reveals even more detail, showing that between 2021 and 2024, 18 emerging brands entered the Italian market, compared to 27 in the top five European markets, while another nine are expected between this year and 2028. In the main EU markets, the total would reach 43: +16 compared to Italy, where interest is also growing, given that 49% of dealers (36% in 2024) are focusing on new brands for the near future (Source: Quintegia Automotive Retailer Perspective 2025). As for the prevailing range of models, among those planned by emerging brands entering Europe, it is in the SUV C and SUV D segments: there are about ten for each in Italy and about fifteen in Europe. The offering is weaker in the A and B segments, which are poorly covered by emerging brands and gradually less covered by legacy brands.

The arrival of new brands is also influencing consumer choices. According to Quintegia’s Automotive Customer Study 2025, 44% of buyers say they are ready to consider these brands. This propensity grows significantly among young people of Generation Z, born at the turn of the millennium, where the percentage rises to 74%.

Among the brands now well known in Italy are MG by SAIC, the various DR brands from Evo to the most recent Tiger, BYD, Omoda and Jaecoo by Chery, Lynk&Co and Polestar by Geely, other emerging brands such as EMC by Eurasia Motor Company with Intergea, Leapmotor with Stellantis, those by Dongfeng, DFSK and others managed by distributors such as AT Flow by Autotorino or under private labels. Denza by BYD is also expected in Italy, among others.

In the first quarter of 2025, MG contributed most to the market share in Italy with 3.5%, followed by BYD with 0.9%, while other brands accounted for less than 0.5%.

There are also brands present in Europe but not in Italy, such as NIO, whose sub-brands Onvo and Firefly are expected to enter the market, and among the non-Asian brands, Ebro in Spain, Vietnam’s VinFast and, increasingly, Togg from Turkey.

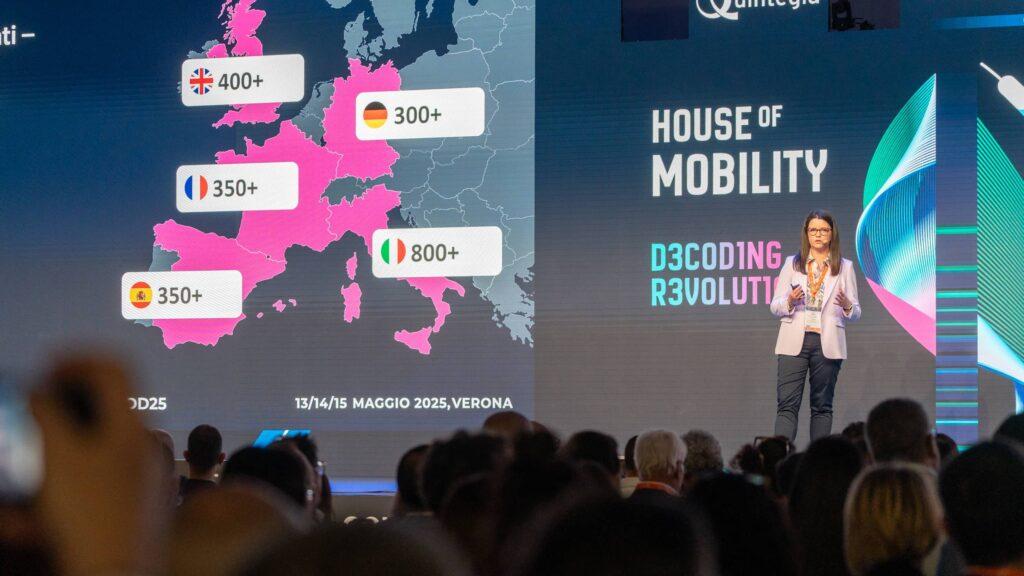

The New Brand Observatory also highlights that the number of new brand outlets in Italy exceeds 800, while in other markets it varies from around 300 in Germany to over 400 in Great Britain. There are more than 400 dealer entrepreneurs representing emerging brands in Italy, with a multi-brand, multi-manufacturer portfolio of over 75%.

The arrival of new brands has also had an impact on the dynamics of the distribution network in Italy: while dealers represented two brands in 2015, in 2025, with the arrival of new brands, they will represent an average of 3.5 brands; one in three dealers of traditional brands also represents emerging brands.

Download the free extract here

New Brand Observatory provides a qualitative overview of new brands entering and entering Europe according to a 6-dimensional analysis framework, with approximately 40 brands analysed out of over 65 observed.

New Brand Deep Dive for a quantitative analysis of the networks of around 20 emerging brands that have entered Italy, compared with the top 5 European countries (Germany, UK, France, Italy, Spain).