The Italian automotive landscape is showing signs of significant transformations, with the Top50 Dealers* representing an interesting point of observation According to analyses conducted by Quintegia, in 2022, these major industry players recorded a growth in their market share, reaching 30.2%, a figure that, thanks to recent acquisitions, will lead to a share of at least 33% for the Top50 by 2025.

Despite a drop in sales, the Top50 Italian Dealers have seen an increase in their profits, with an average Return on Sales (Ebit) rising to 3.00% in 2022, from 2.23% the previous year Additionally, average financial indicators are on the rise, with the ROS (Ebit) per location approaching one million euros and the ROS per employee reaching €30,000. These data are particularly impressive when analyzed per employee, where an increase of about 50% on the absolute value is recorded.

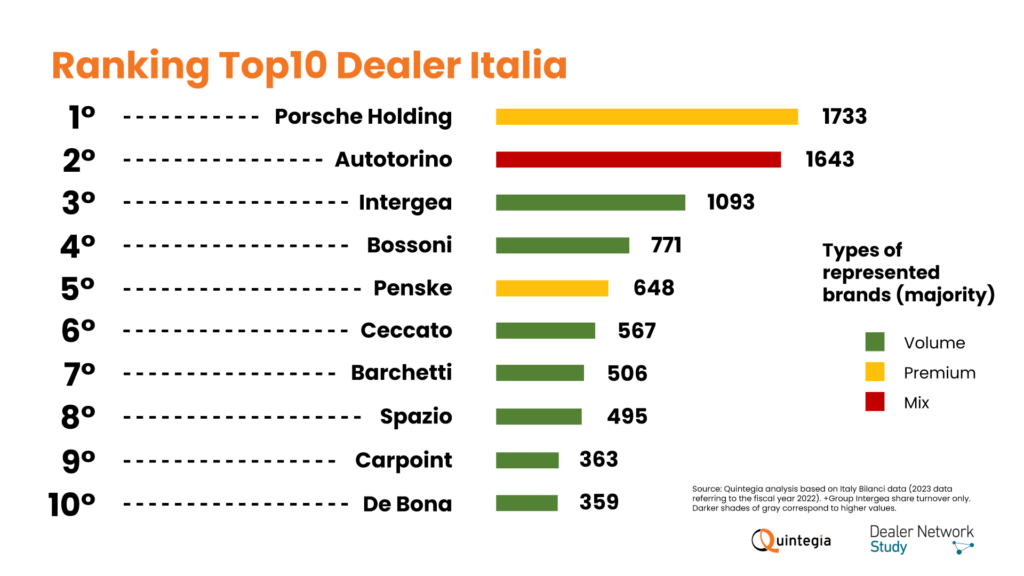

The market leaders in 2022, based on turnover, were Porsche Holding, Autotorino, Intergea, Bossoni, and Penske. These giants have maintained their dominant positions, although the ranking has seen some changes in the subsequent positions, withCarpoint entering at ninth place. To enter the Top50, the turnover threshold was 170 million euros, a sign of the ongoing consolidation in the market and the opportunity to leverage some economies of scale.

Throughout 2022, there was a decrease in the ratio of used to new vehicles sold for both European and Italian dealers, a sign of an automotive market going through atypical conditions. This trend has shifted dealers’ attention towards the used car market, a dynamic supported by data: the average ratio stabilized around 0.60 in Italy. Moreover, the retail sales share of used cars reached 62%, with an average value per used vehicle approaching €15,000 per car.

The market, in 2023, also witnessed numerous acquisitions, 15 in the last year alone, which included the transfer of three direct branches (Mercedes-Benz Rome, Renault Retail Group Milan, and Renault Retail Group Rome) to private dealers. This change in strategy by the manufacturers reflects a new market dynamic and the search for more flexible and adaptive business models.

Looking to the future, the Top Italian Dealers are adopting growth strategies that emphasize the transition to new mobility concepts. Investments are gradually shifting towards new business areas, including energy and mobility, and towards digitalization, such as the use of advanced technologies like artificial intelligence and big data management. Looking at the evolution of these entrepreneurs’ brand portfolios, the trend seems to be consolidating the number of traditional brands in the portfolio and adding new brands making their debut in Europe, particularly Chinese ones.

The focus on ESG (Environmental, Social, and Governance) is becoming increasingly central to dealers’ strategies, with the adoption of innovative approaches aimed at transforming the work environment and the employment model. This evolution reflects a growing commitment to sustainability and social responsibility, demonstrating how the Italian automotive sector is responding to the challenges of our time with boldness and vision.

* Income statement of the Top 50 Dealers in Italy (entrepreneurial groups of dealerships) compiled for the total revenue of 2022 (financial statement 2023).