PRESS RELEASE

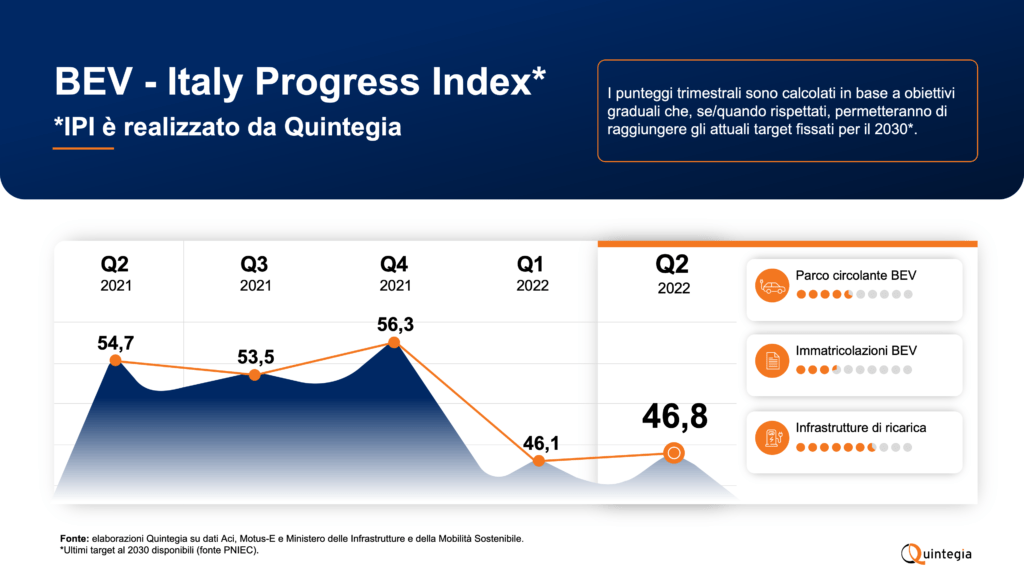

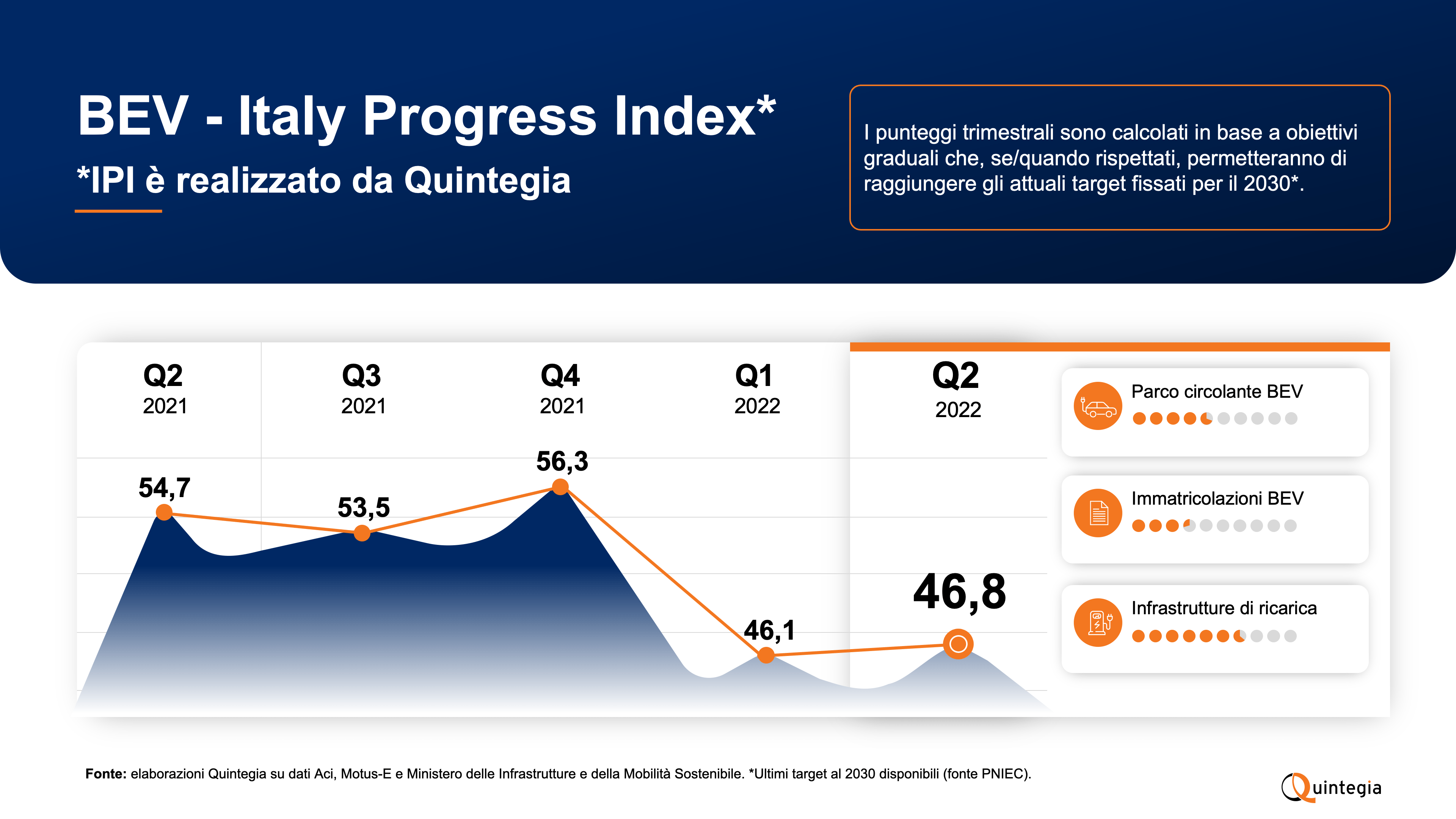

In June, registrations of fully electric cars amounted to 6,190, a decrease of 11.9% compared to the same month in 2021. This data has had an impact on the index, which has reached 46.8 between April and June.

Treviso, July 11, 2022 – Italy is falling behind in meeting the current targets for 2030, and the progress toward preparing our country for the major changes required by the electrification of the automotive sector has stalled in 2022 compared to the growth seen in 2021.

This is what the BEV – Italy Progress Index, a quarterly index produced by Quintegia, reveals. The analysis takes into account three main components:

- The BEV (Battery Electric Vehicle) circulating fleet,

- Quarterly BEV registrations (Battery Electric Vehicle)

- Electric charging infrastructure, evaluated for its distribution and power output.

The index, represented by a score ranging from 0 to 100, indicates the percentage of achievement of gradual quarterly objectives that, if met, will enable the attainment of the latest available targets set for 2030 (PNIEC). In the second quarter, the score stands at 46.8, compared to 46.1 in the previous three months and 56.3 in the last quarter of the previous year.

“This score is the result of several interacting components. The effect of incentives on registrations was not immediate but will be spread over time due to product scarcity and the resulting extended delivery times for new car orders. Wait times can even exceed six months, to the extent that the government has extended incentives for vehicle registration communication from 180 to 270 days,” states Nicola Pasqualin, Researcher & EV Specialist at Quintegia – “Furthermore, inflation due to the current geopolitical situation and the strategic choices of automakers, combined with the significant development costs incurred to electrify their range, have steadily increased car prices. The index serves as a reference point for observing and understanding the level of electrification in the Italian automotive market, with the aim of facilitating discussion and studying targeted solutions.”

Looking at the details, it becomes apparent that the registration numbers are not sufficient to keep up with the necessary pace to achieve the current targets for 2030. The BEVs currently on Italian roads number just under 150,000, accounting for only 3.7% of what the current targets aim for by 2030.

The incentives introduced in May for low-emission vehicles seem to be starting to have an effect, with increased registrations compared to the first months of the year. While funds for the 61-135 g/km emissions category were depleted before mid-June, there is still a very high availability for plug-in hybrid and fully electric cars.

In June, registrations of fully electric cars amounted to 6,190, a decrease of 11.9% compared to the same month in 2021. However, this is an improvement compared to the -19.1% recorded in the first five months of 2022. The market share of BEVs (Battery Electric Vehicles) in June is just under 5% of the total registrations. Thanks to incentives, the private sector is growing, responsible for 48% of BEV registrations in the last two months, compared to 34% in the January-April period.

These results have led to a decline in the score of the circulating fleet component, a factor that has not allowed BEV-IPI to register significant growth in this quarter.

Positive aspects can be seen in the infrastructure component. In the last 3 months, the growth of charging points on highways, although still relatively small in number and distribution, has increased by 56%, with a total of 235 points installed. There were 1,363 public charging infrastructure installations in Italy from April to June, with 13% being high-speed, providing more than 50 kW of power.