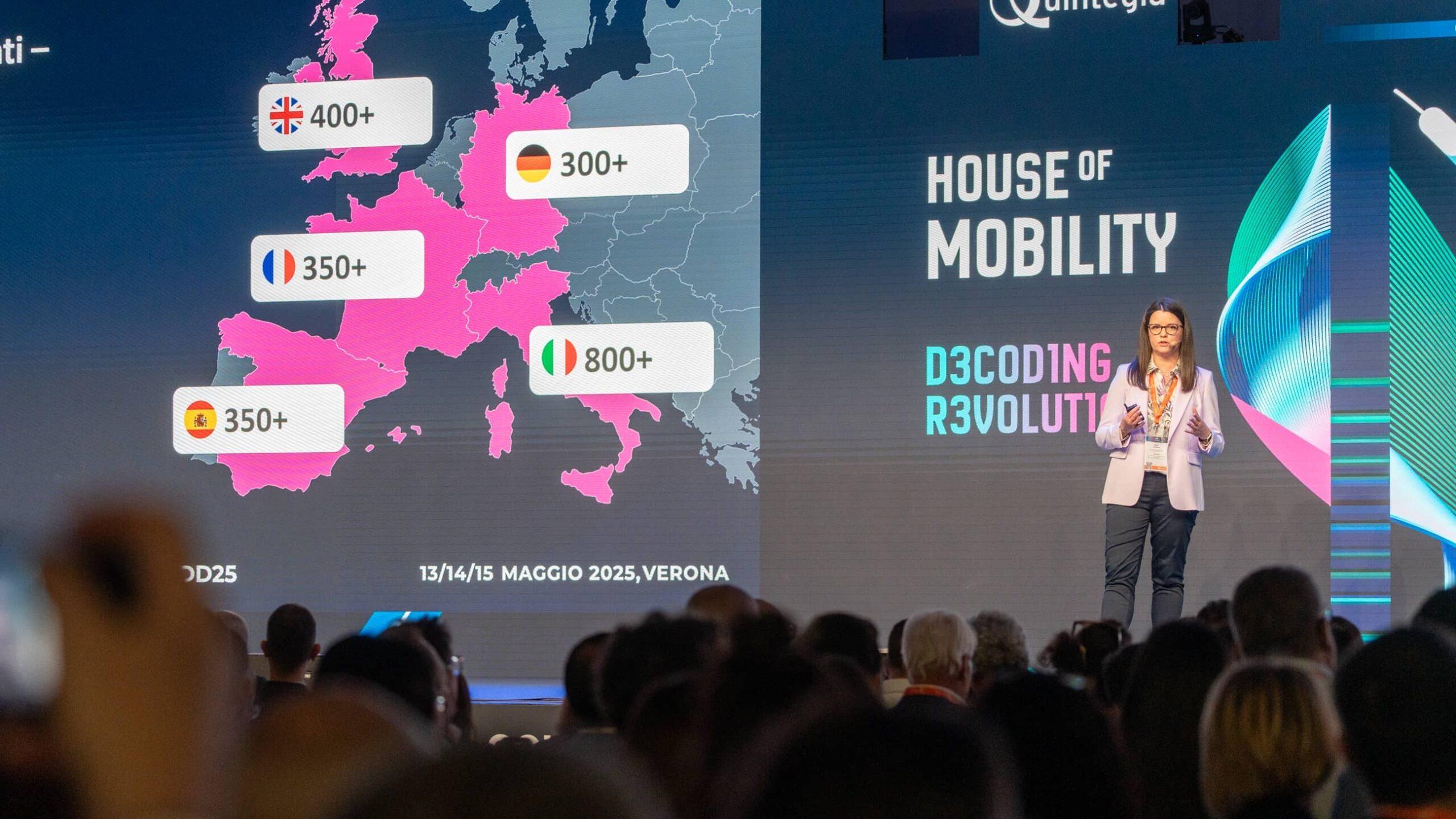

Italy is lagging behind in Europe both in terms of used car sales to end customers, considering that in the last 10-15 years, there have been an average of around 3 million units sold (compared to France and Germany, which have sold 6/7 million units), and in the used-new car ratio, where for every 3 used cars sold to private individuals, only 1 new car is sold. In general, the trends show growth, and even though this business is much more significant in other European countries, the data reveal an opportunity for all Italian operators to understand the still untapped potential of this market, which saw a 13.3% increase in 2021 (source: ACI). Borrowing the words spoken by Dario Mennella of BMW Italy at the Automotive Dealer Day 2022, it can be said that ‘the used car business is the protagonist of a new Renaissance’.

Many have already sensed the potential opportunities generated by this business, and new entrants, often characterized by a strong digital component and supported by excellent levels of stock capitalization, are changing the rules of the game. These new players are pushing traditional retail toward significant changes: centralized management of vehicle stocks, the creation of remote BDC (Business Development Centers) away from sales points, increased investments required for data and technology, and changes in the role and profile of salespeople.

To understand how dealers should adapt, it’s necessary to consider the evolution of consumer behavior. According to the study by Quintegia and ICDP, it emerges that used car customers often don’t have very clear ideas. In fact, only 49% of them know the specific brand and model they desire in the early stages of the customer journey. The 65% of those surveyed purchased a car from the brand they had in mind but not the specific model, while 35% bought a vehicle from a different brand than initially considered. When looking at key factors in choosing a used car over a new one, consumers are primarily driven by affordability and product availability. The surveyed sample also ranks the lack of clarity in provided information (47%) as the top area for improvement in the purchasing process. Used car customers also appear to be more inclined toward online purchases, especially as they approach the conclusion of the transaction, with a growing demand for an omnichannel experience. It’s important to note that new and used car customers are similar in their interest in additional services (e.g., comprehensive maintenance packages); they often have the same needs, even from an insurance perspective.

Another business undergoing significant evolution is after-sales service One crucial aspect to consider is the circulating vehicle fleet: according to GiPA Italia estimates, there have never been as many cars on the road as there are today, with 33 million vehicles used by Italian households. Over the last 10 years, the fleet has increased by 1,275,000 vehicles (4%), with only slight reversals in 2014 (-0.3%) and 2022 (-0.1%). The pandemic affected registrations and service demand but didn’t disrupt the size of the fleet. This is becoming increasingly saturated and outdated, this characteristic drives the demand for service, leading to a rise in workshop volumes between 2010 and 2020, despite the crisis, with a marked increase in entries (the number of times a vehicle entered the workshop).

In general, the scenario for post-sales businesses remains complex: the product features increasingly sophisticated technology, resulting in repair complexity that should not be underestimated. Customer expectations are growing, and manufacturers have higher service standards, tying the dealer’s profitability more to the achievement of defined KPIs. This implies the need for dedicated resources with broader and diversified skills compared to traditional ones, increased personnel and structural costs, and overall greater time and activity pressure on all workshop resources.

After-sales will evolve organizationally and increasingly be a channel for selling services. Some have already moved in this direction, implementing a series of initiatives, as testified by Matteo Soncini, General Manager of Motorsclub.com, at Veronafiere. After conducting market analyses, this company better understood its customers’ real needs and, to meet the demand for safety and convenience, established a 24/7 assistance and operational system. This offered several benefits, such as reduced waiting times for complex repairs and the customer’s freedom to choose the most suitable time for maintenance interventions.

Another implemented service that has received highly positive feedback is the ‘pick-up and delivery,’ useful to meet the needs of customers unable to move. In the future, with the development of electric mobility, it will also be possible to provide ‘Service to home,’ as EVs require less invasive mechanical interventions. These are just some of the upcoming services that will characterize the after-sales world, offering numerous opportunities for businesses in this sector. They will continue to focus on the customer and meet their growing expectations with a multi-service offering.