340 million euros in average revenue in 2021 by the top 50 automotive dealership groups in Italy, with an overall market share that could exceed 30% in 2022.

Top50 Dealer, Quintegia’s analysis that has been illustrating the performance of automotive dealerships in Italy for over twenty years, reveals this year that Top50 italian dealerconsidering the consolidated group revenue in the automotive sector are in good health: the average total revenue in 2021 amounted to 340 million euros,with a forecasted growth for 2022 expected to surpass 360 million euros due to additional acquisitions by some large groups.

The analysis highlights how, compared to 2011 with an average revenue of 189 million euros, the data has seen an increase of +80% over 10 years, with a significant growth in the average number of employees as well, rising from 216 in 2011 to over 350 in 2021.

The financial “health” of these large entities has also improved, for example, the average ROS (Return On Sales, thus the profitability of these companies) has seen a strong growth: in 2011, it was 1.18%, in 2021, it reached 2.27%largely due to exceptional market conditions.

In the Italian market, from 2011 to 2021, the top 50 dealership groups, in relation to the sale of new vehicles, have increased their overall share from 17.6% in 2011 to 29.1% in 2021, with a likely upward trend for 2022, possibly settling around 30,5%.. In terms of units, last year, 424,477 vehicles were sold, and this year, the total volumes of the top 50 dealers are expected to decrease by about 5%, also due to the well-known product shortages, but still surpassing 400,000 units..

It is the used car market that has shown the strongest growth, with a +58% increase (on average, 3,432 used cars sold in 2011 and 5,431 last year by each group): this is a strong signal of how Italian dealerships have begun to invest more in this businesswhose potential is still largely unexplored, especially in light of what is happening in other markets where the ratio between new and used cars is close to or exceeds the 1:1 value..

In relation to the average number of sales outlets, a slight decrease has been recorded, linked to the opportunity for some companies to rationalize their presence in the territory.

Review the analysis conducted by Luca Montagner in the November episode of Automotive Forum LIVE.

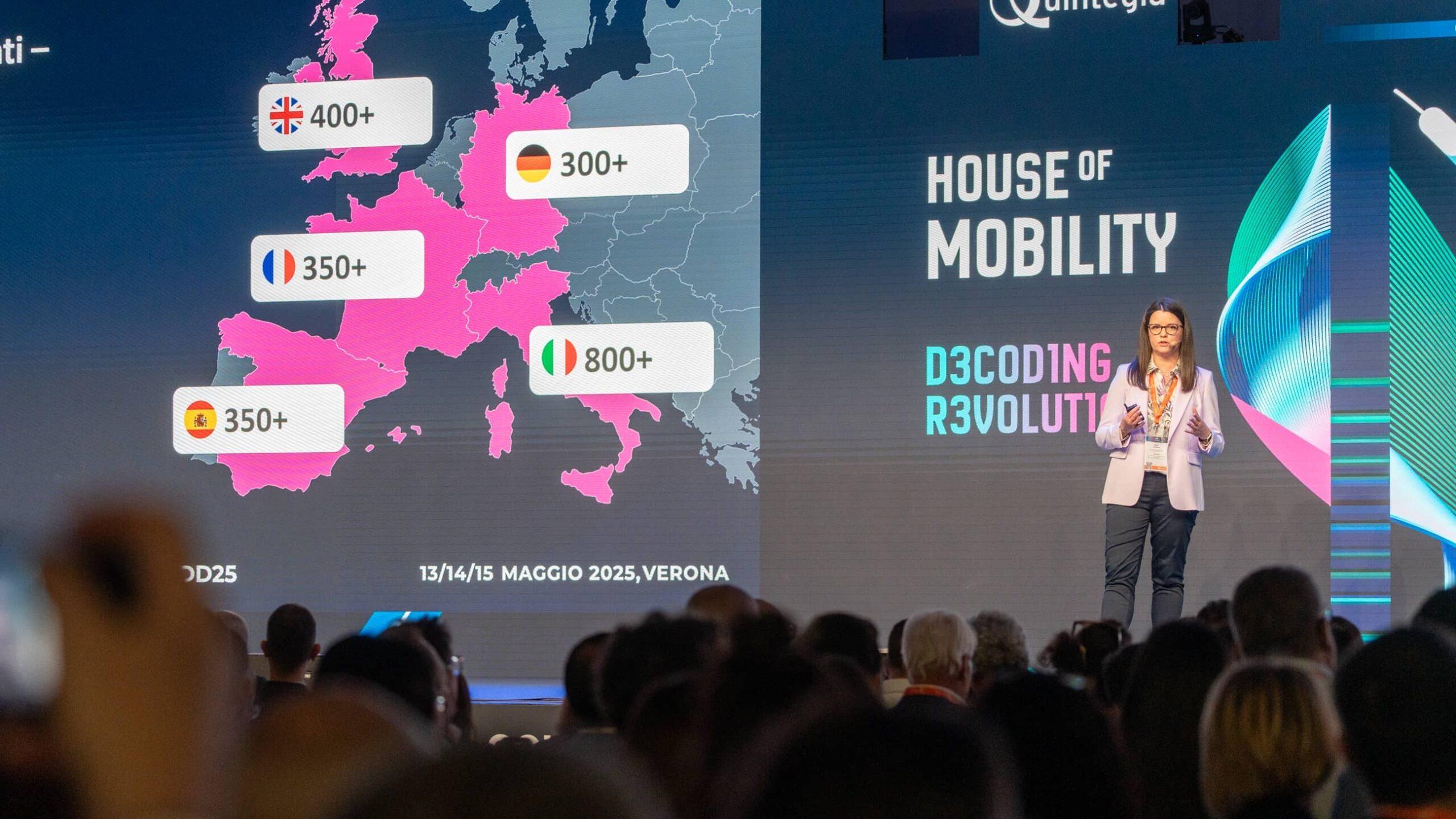

“Now the challenges for dealerships, especially the larger ones – explained Luca Montagner, Partner, Senior Advisor at Quintegia – are related to the opportunity to capitalize on the trend towards electric transition. Unfortunately, Italy is still lagging behind in Europe (where in many cases the market share of electric vehicles has already exceeded 12-14%). Additionally, there is a need to consolidate their presence in the digital sphere by offering new solutions for an integrated online-offline experience to buyers, and to better leverage the used car and after-sales businesses, given the possible shift to the agency model for the sale of new cars by various automakers, which will reduce dealerships’ autonomy in this regard.””.