“Electric Mobility: Inevitable or Not? Consumer Perspective Analysis” conducted by Quintegia and Motus-E, is the most extensive research to date on European consumers’ attitudes toward purchasing electric vehicles (EVs).

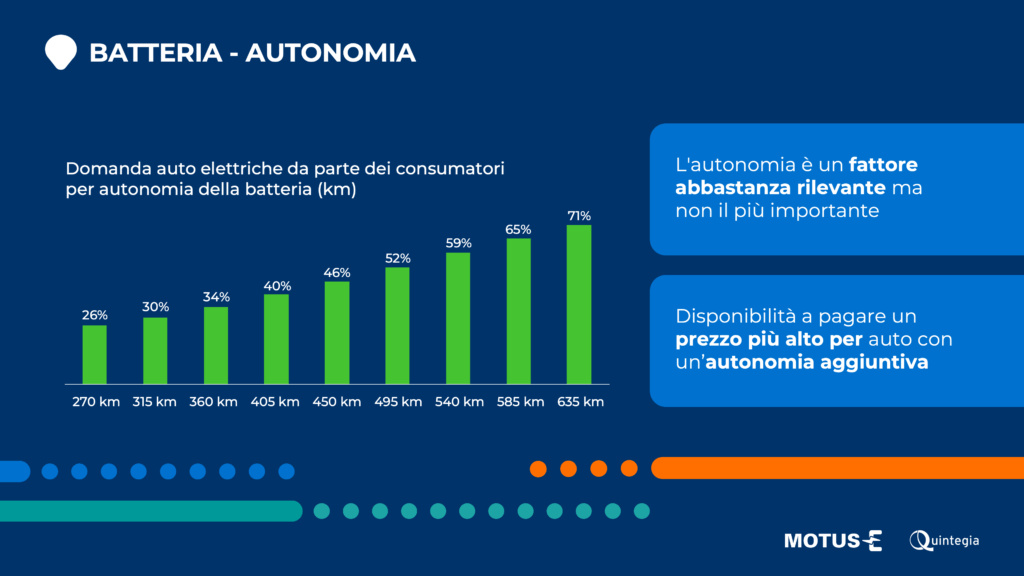

In the previous article, it was revealed that the price of Battery Electric Vehicles (BEVs) is the most significant factor influencing consumer purchase decisions. Another important factor is the battery range, as data indicates that demand for electric vehicles increases with greater driving range.

Most electric cars currently have a range of between 200 and 500 kilometers, although upcoming models are expected to offer ranges of 400-600 kilometers. Consumer responses show that some individuals would be willing to pay a higher price for cars with extended autonomy. It has also been calculated that if the purchase price and operating costs for all types of vehicles were equal, most consumers would choose an electric car if it had a range between 270 and 635 kilometers.

When discussing zero-emission vehicles, two other types of power sources that could potentially be alternatives to electric cars in the future are hydrogen and synthetic fuels (e-fuels).

As for the first type of alternative propulsion, the study finds that the demand for electric vehicles would not significantly decrease if hydrogen-powered cars gained traction in the market. This is because consumers do not perceive them as a valid alternative to Battery Electric Vehicles (BEVs) due to their higher price. If a significant number of hydrogen cars were introduced to the market by 2025, they are estimated to have an average premium of €12,000 compared to an electric car, which is expected to decrease to €4,800 by 2040.

The demand for electric cars would also not decrease substantially if e-fuels were introduced to the market, as they are less cost-effective for consumers and less environmentally efficient.

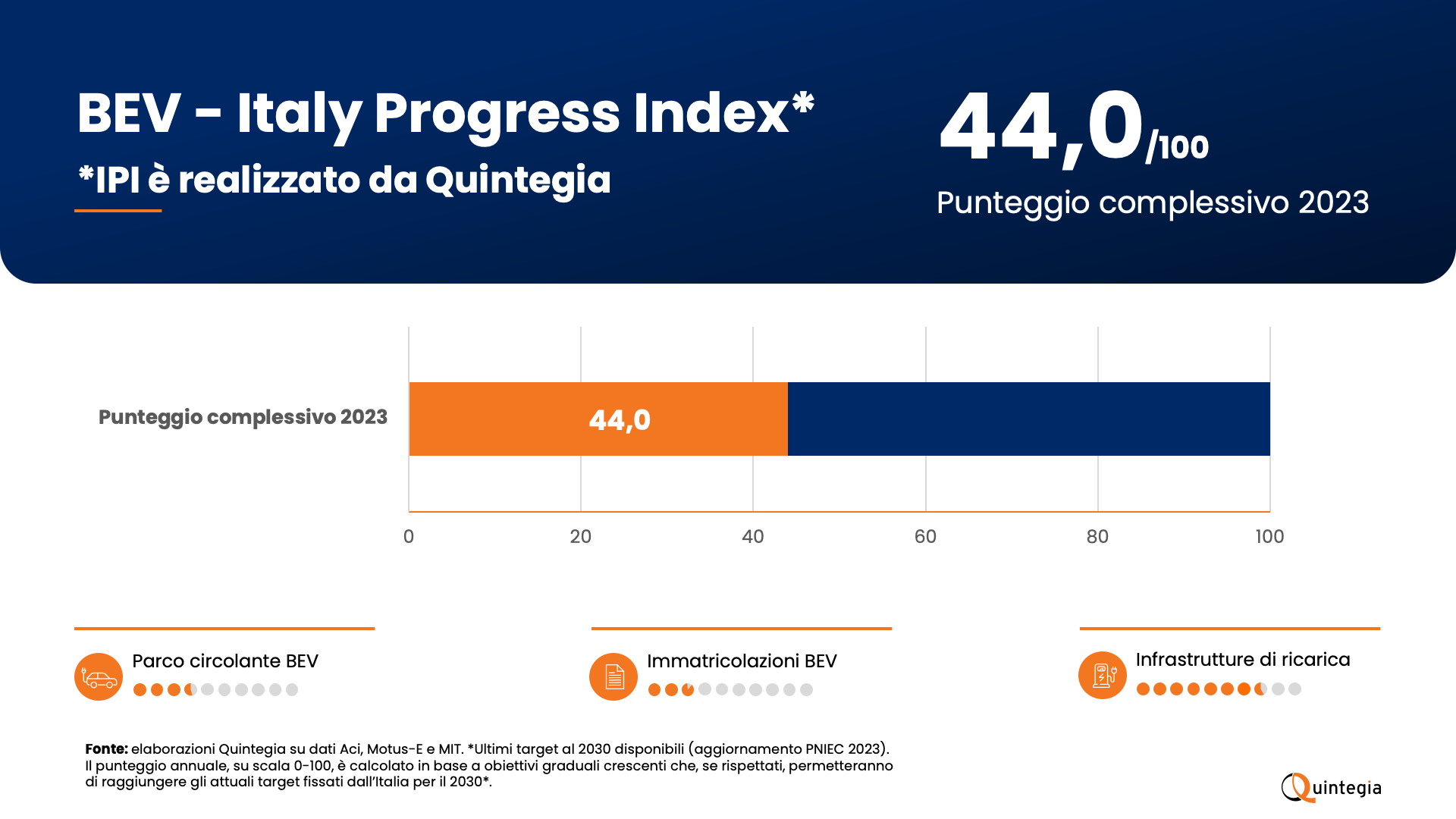

Therefore, according to consumers, electric power is considered the best solution among renewable energy alternatives. It is important to understand how charging methods impact purchase decisions. According to Motus-E’s December 2021 data, there are 26,024 charging points across 13,223 charging infrastructure locations in Italy, with 80% located on public land and 20% on private land for public use.

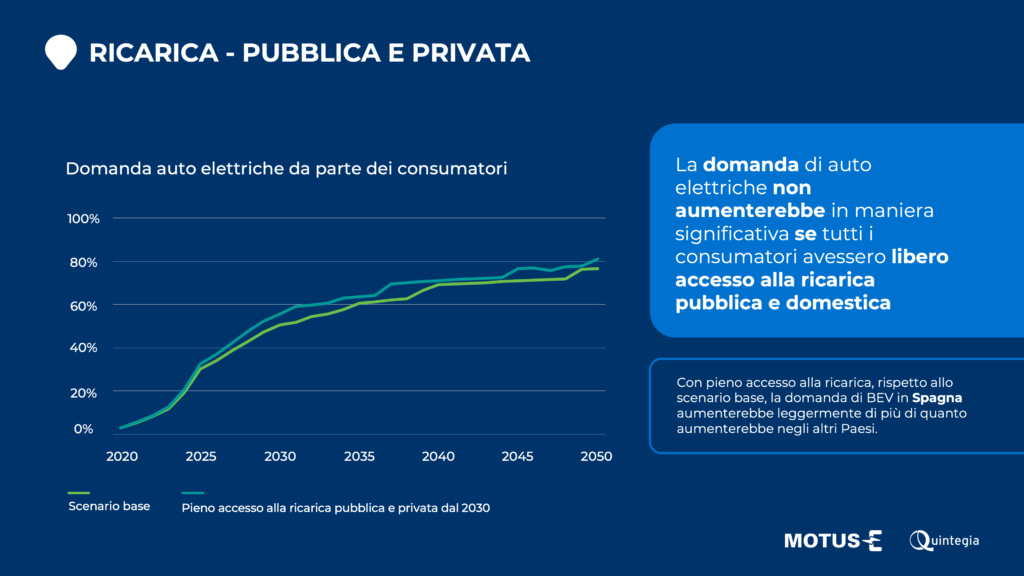

The availability of public charging infrastructure is undoubtedly an important factor in the choice to purchase an electric car, but as the data from the report shows, it alone does not significantly influence the demand for Battery Electric Vehicles (BEVs). However, particularly in Italy, improving the coverage of charging infrastructure could unlock significant latent demand. Therefore, it is important for infrastructure development to keep pace with vehicle registrations.

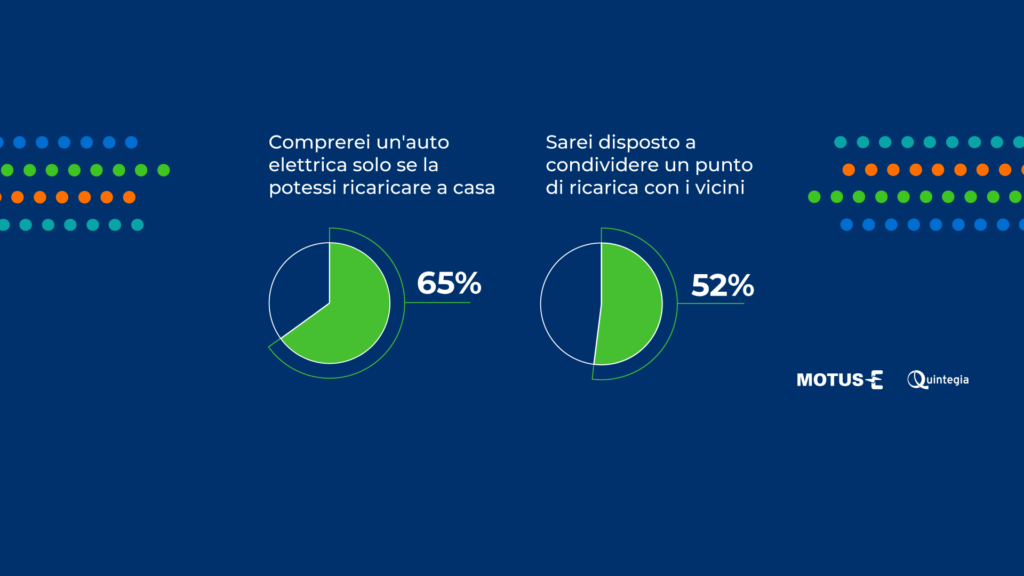

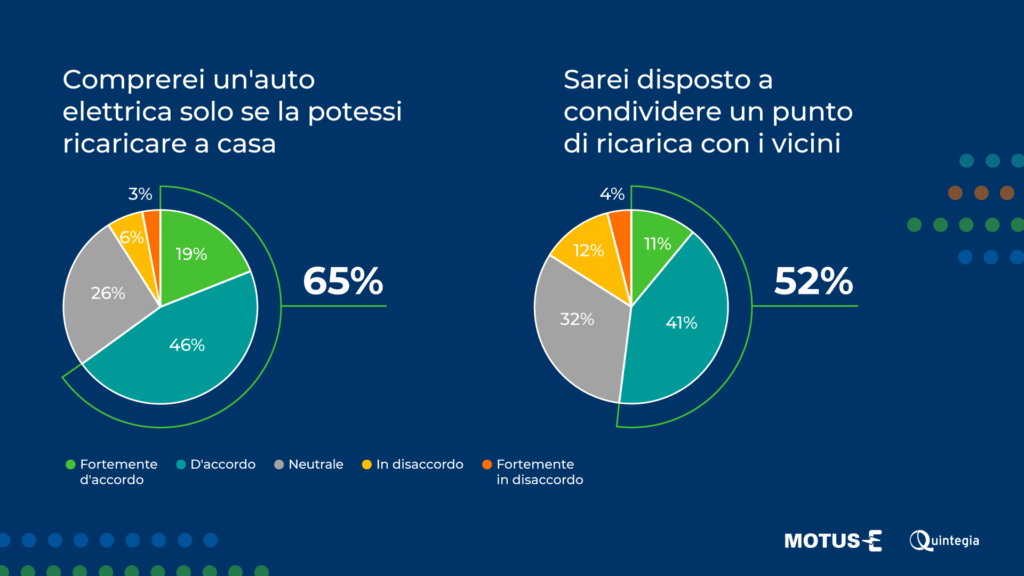

Regarding access to private charging, consumers consider it 50% more important than access to public charging. It has been estimated that 65% of the sample would purchase a BEV if they had the ability to charge it at home, even by sharing a charging station. However, access to home charging does not seem to be a significant concern, as 59% of respondents already have access to private parking (garage or driveway), and an additional 30% do not park their cars on the street. This indicates that most consumers would already have the potential to access a private charging point.

Assuming that all consumers have access to both home and public charging by 2030, and that access to charging is no longer a barrier to electric vehicle adoption, there are no substantial differences compared to the base scenario. In other words, the demand for electric vehicles would not increase significantly if everyone had free access to charging, with growth remaining below 10 percentage points in all years and a peak expected between 2030 and 2035. There is no noticeable difference between the two scenarios because, before 2030, the demand for electric vehicles is limited by the significant difference in purchase price compared to other power sources, while after the mid-2030s, the substantial price parity is perceived as more important than any other disadvantage.